tax identity theft meaning

Sign Up for a 30 Day Trial Today. Your Credit Can Too.

Irs Notice Cp01 Identity Theft Claim Acknowledgement H R Block

Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number.

. This may reduce your. If you suspect you are a victim of tax identity theft here are some steps to follow. Certain tax-related identity theft victims will be placed into the Identity Protection PIN program and annually receive a new six-digit IP PIN.

Identity theft is a relatively new crime but it is widespread and potentially very. Place a fraud alert on your credit file with one of the three major credit bureaus. Identity ID theft happens when someone steals your personal information to commit fraud.

The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors. Equipped with three simple ingredients a name birthdate and Social Security number. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors.

The tax identity theft risk assessment will be provided in January 2019. This offense in most circumstances carries a maximum term of 15 years imprisonment a fine and criminal forfeiture of any personal property used or intended to be. Consumers can take these steps to help prevent tax identity theft.

ID theft through a tax professional. You might think youre in the clear because you. Discover Your Credit Potential.

People often discover tax identity theft when they file their tax returns. There are a lot of ways ones identity can be stolen. Ad Life Changes Fast.

You tell us you may be a victim of tax. The IRS outlines its definition of tax identity theft as occurring when someone uses your stolen personal information. Eg name login Social Security number SSN date of birth etc of someone else to assume their identity or.

Tax identity theft is when someone uses your Social Security number to steal your tax refund or for work. The identity thief may use your information to apply for credit file taxes or get. Identity theft occurs when a criminal obtains or uses the personal information.

The tax identity theft risk assessment will be provided in January 2019. Cybercriminals Find New Ways to Steal Identities. Protect with Powerful Tools.

Tax identity theft happens when someone uses your personal information to file a tax return claiming the fraudulent returns are yours. This type of ID theft happens when fraudsters break into the secure systems of actual tax preparers and online tax preparing systems. See Your Score Report Now.

Ad LifeLock Alerts You to Activity Around Your Social Security Number in Their Network. Cybercriminals Find New Ways to Steal Identities. Identity theft is the crime of obtaining the personal or financial information of another person for the sole purpose of assuming that persons name or identity to make.

Tax return identity theft is the act of filing a return using a stolen identity and taking the victims refund. Apply for an Electronic Filing PIN number from the IRS and register with the IRS. One of the major identity theft categories is tax identity theft.

Using all 3 will keep your identity and data safer. Ad LifeLock Alerts You to Activity Around Your Social Security Number in Their Network. Get Score Planning Report Protection Tools Now.

Sign Up for a 30 Day Trial Today. Tax attorneys may be called upon to help clients if they are victims of identity theft such as refund theft. The most common method is to use a persons authentic name address and Social Security Number to.

The accepted employment identity theft definition is when another person uses your identity usually in the form of a social security number to apply for a job under false.

What Is Identity Theft Identity Fraud Vs Identity Theft Fortinet

Tax Identity Theft American Family Insurance

What Is Identity Theft Definition Bankrate

Identity Theft Definition What Is Identity Theft Avg

Irs Notice Cp01c We Verified Your Identity H R Block

How Common Is Tax Identity Theft Experian

Fraudulent Tax Return And Identity Theft Prevention Steps

Irs Letter 4883c Potential Identity Theft During Original Processing H R Block

Identity Theft Information Reporting And Preventing Identity Theft And Additional Information And Resources Fraud Prevention

What Is Identity Theft Definition From Searchsecurity

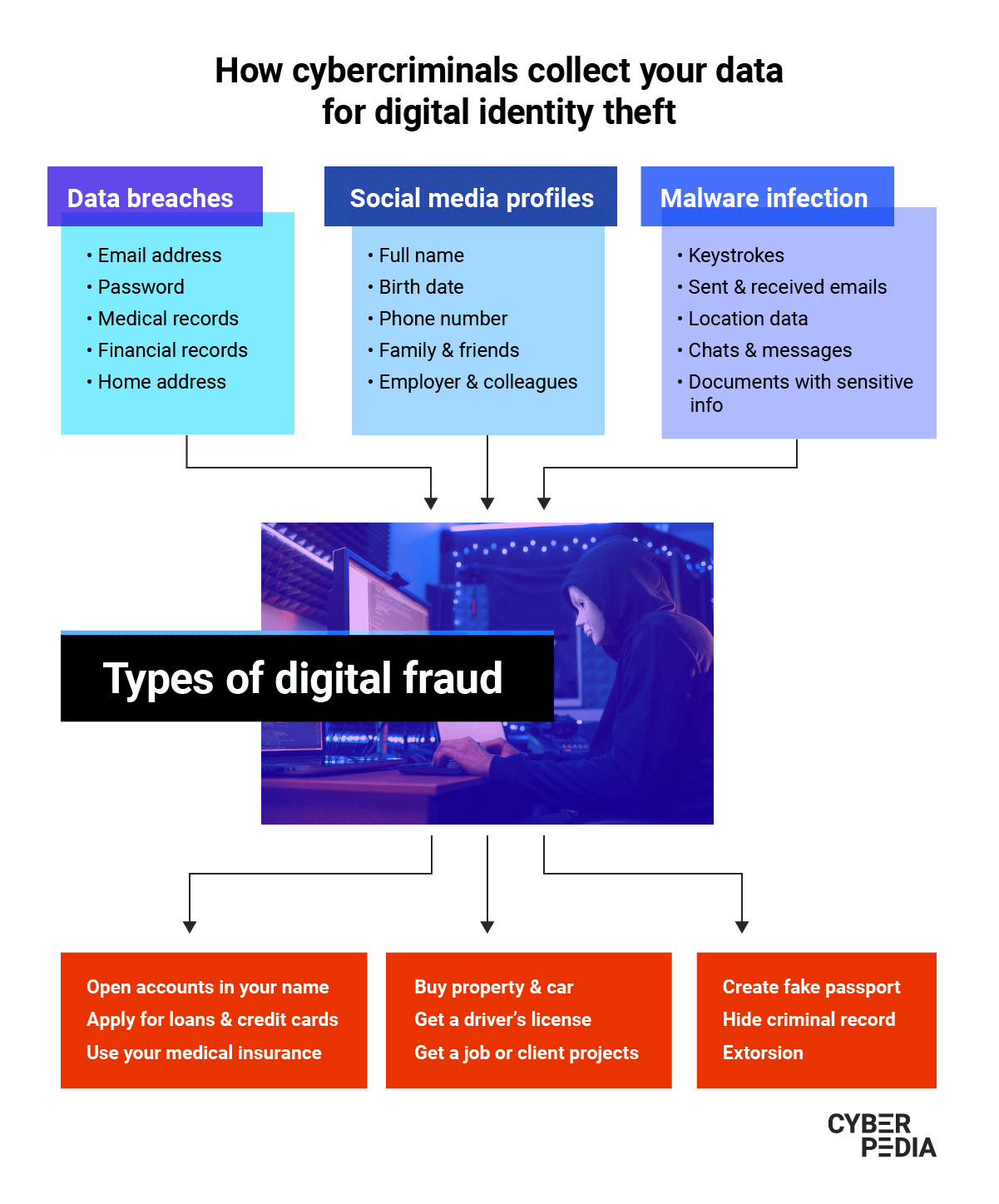

What Is Digital Identity Theft Bitdefender Cyberpedia

Irs Notice Cp01s Message About Your Identity Theft Claim H R Block

What Happens After You Report Tax Identity Theft To The Irs H R Block

Irs Notice Cp01a The Irs Assigned You An Identity Protection Personal Identification Number Ip Pin H R Block

Types Of Identity Theft And Fraud Experian

Stolen Tax Refund Check Here S How To Get Your Money Back Aura

/identity-theft-in-asia-56fe41915f9b586195f2a98d.jpg)